Medicare 101: Your Guide to Medicare Coverage & Costs

Select a section below or scroll to read the full guide.

- What is Medicare?

- What Does Medicare Cover?

- What Are My Coverage Options with Medicare?

- How Does Medicare Cover My Healthcare Needs?

- Who Qualifies for Medicare?

- How Much Does Medicare Cost?

- Should I Enroll in Medicare If I Have Employer Coverage at 65?

- When Should I Enroll in Medicare?

- What Are the Enrollment Steps for Medicare?

- How Do I Choose the Right Medicare Option for My Needs?

Tap a section title below to expand and learn more about Medicare.

What is Medicare?

Medicare is a federal health insurance program for people aged 65 and older, as well as certain younger individuals with disabilities or end-stage renal disease. It helps cover the cost of hospital care, doctor visits, preventive services, and prescription drugs through different parts of the program. Medicare is designed to provide reliable, affordable healthcare as you age, though it doesn’t cover everything. Hence, reviewing your options is important.

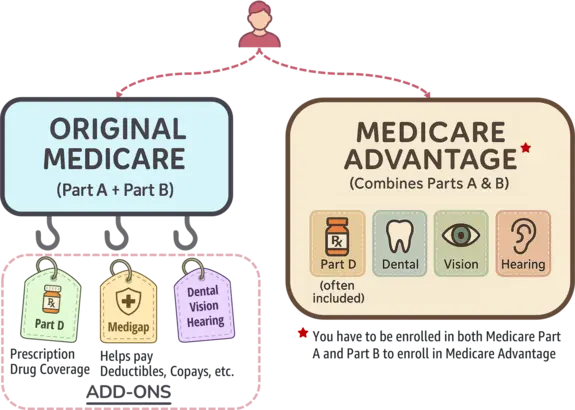

Medicare can sometimes mean different things to different people. That’s because there are different ways to receive your Medicare benefits. Some people stay with what’s called Original Medicare, while others enroll in a Medicare Advantage plan that replaces it. And some people choose to add a Medicare Supplement (Medigap) plan to help pay for costs Original Medicare doesn’t cover. Understanding which path you are on, or want to be on, is a key part of planning your healthcare.

To summarize:

- Original Medicare: The traditional government-run program that includes hospital insurance (hospital stays, skilled nursing facility, etc.) and medical insurance (doctor visits, lab tests, etc.), offering broad access to providers nationwide.

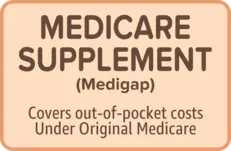

- Medicare Supplement (Medigap): Add-on coverage that helps pay your share of costs (like deductibles and coinsurance) when you stay with Original Medicare.

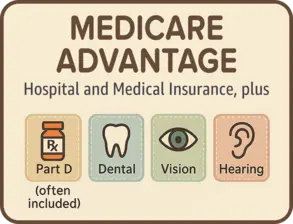

- Medicare Advantage: An all-in-one alternative to Original Medicare, offered by private insurers, that includes hospital insurance, medical insurance, often with prescription drug coverage, and extra benefits like dental, vision, and hearing.

What Does Medicare Cover?

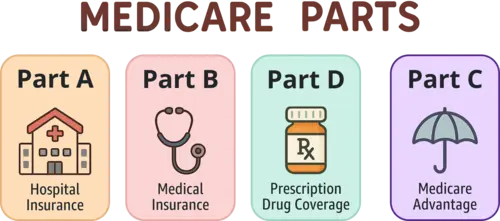

Medicare offers different types of coverage through four parts – each designed to meet specific healthcare needs. Understanding what each part covers can help you make informed choices about your health insurance options. Here’s a breakdown of what’s included in each part of Medicare.

Medicare has Parts!

- Part A – Hospital Insurance

- Part B – Medical Insurance

- Part D – Prescription drug coverage

- Part C – Medicare Advantage (a private plan that combines Parts A and B, often Part D, and some extras)

Part A: Hospital Insurance

Part A covers inpatient care in hospitals, care in skilled nursing facilities, hospice care, and some home health care. It helps provide coverage when you are formally admitted to a hospital or require short-term recovery in a facility after a hospital stay.

Part B: Medical Insurance

Part B covers outpatient medical services, including doctor visits, preventive care, mental health services, lab tests, X-rays, and certain home health services. It also includes medically necessary services like surgeries and durable medical equipment.

Part D: Prescription Drug Coverage

Medicare Part D helps cover the cost of prescription drugs, including both brand-name and generic medications. Coverage varies by plan but typically includes medications for common conditions and those prescribed by your doctor.

QUESTIONS ABOUT MEDICARE PART D?

Learn about Prescription Drug PlansPart C: Medicare Advantage

Medicare Advantage plans are offered by private insurance companies and combine the coverage of Parts A and B. Most plans also include prescription drug coverage and may offer additional benefits such as dental, vision, hearing, and fitness programs. Some plans also provide help with everyday needs, including over-the-counter items, transportation, and grocery or meal assistance for eligible members.

You must be enrolled in Medicare Part A and Part B before you can sign-up for a Medicare Advantage Plan.

What are My Coverage Options with Medicare?

When you first become eligible for Medicare, you usually have two ways to get your coverage: Original Medicare or Medicare Advantage.

Both options cover your core healthcare needs, but they differ in how that coverage is delivered and what’s included. The illustration below shows how these two options lead to different types of coverage.

Here’s the breakdown of both choices:

Option 1: Original Medicare – A La Carte Coverage

Original Medicare works like a build-your-own plan. It includes Part A and Part B, but if you take prescription drugs, you’ll need to add Part D. If you want dental, vision, or hearing coverage, you’ll need separate plans.

You’ll also face premiums, deductibles, and 20% coinsurance for most services. To help manage those out-of-pocket costs, many people purchase a Medigap (Medicare Supplement) policy – but that comes with an additional premium. Flexibility is a plus, but the pieces (and costs) add up.

Looking for more information about Medicare Supplement?

Explore Medicare Supplement PlansOption 2: Medicare Advantage – All-in-One Simplicity

Medicare Advantage plans combine Parts A and B into a single plan and often include Part D. Most also bundle dental, vision, and hearing, and some even offer extra perks like over-the-counter benefits, groceries, or rides to appointments.

These plans typically have set copays and an annual out-of-pocket maximum, making costs more predictable. However, you’ll need to use the plan’s provider network, and coverage details vary by plan – so it’s important to compare options carefully.

Want to learn more about Medicare Advantage?

Explore Medicare AdvantageHow Does Medicare Cover My Healthcare Needs?

Medicare can help meet a variety of your healthcare needs, from routine doctor visits to hospital stays, home health care, and hospice support. Below, these needs are grouped into four categories – routine, recovery, ongoing care, and end-of-life care, along with a comparison of how Original Medicare and Medicare Advantage typically provide coverage.

1. Routine and Preventive Care

Your routine healthcare needs through regular doctor visits, preventive screenings, and early detection of health issues.

| Service | Original Medicare | Medicare Advantage |

|---|---|---|

| Doctor Visits and Annual Checkups | ||

| Preventive Services | ||

| Lab Tests and Screenings | ||

| Dental, Vision, and Hearing Care (DVH) | * | |

|

*

A separate supplemental insurance must be purchased for these services.

|

||

2. Treatment and Recovery

Your treatment and recovery needs through hospital stays, outpatient procedures, mental health care, rehabilitation services, and medical equipment.

| Service | Original Medicare | Medicare Advantage |

|---|---|---|

| Hospital Stays | ||

| Outpatient Services and Procedures | ||

| Emergency Room and Urgent Care Visits | ||

| Prescription Medications | * | |

| Mental Health Care | ||

| Rehabilitation and Therapy Services | ||

| Durable Medical Equipment (DME) | ||

|

*

A separate Medicare Part D plan must be purchased for prescription drug coverage.

|

||

3. Ongoing or At-Home Care

Your ongoing and at-home care needs through skilled nursing facility care, home health services, long-term custodial care, and transportation assistance.

| Service | Original Medicare | Medicare Advantage |

|---|---|---|

| Skilled Nursing Facility (SNF) Care | ||

| Home Health Services | ||

| Long-Term Custodial Care | * | * |

| Transportation to Medical Appointments | ||

|

*

A separate private long-term care plan must be purchased; if eligible, Medicaid may provide coverage; some Medicare Advantage plans may offer limited benefits.

|

||

4. End-of-Life and Compassionate Care

Your end-of-life and compassionate care needs through hospice services, emotional support, and palliative care.

| Service | Original Medicare | Medicare Advantage |

|---|---|---|

| Hospice and End-of-Life Care |

Who Qualifies for Medicare?

Most people qualify for Medicare when they turn 65 if they are U.S. citizens or permanent legal residents who have lived in the country for at least five continuous years. You’re typically eligible for premium-free Part A if you or your spouse paid Medicare taxes for at least 10 years. People under 65 may also qualify if they’ve received Social Security Disability benefits for 24 months or have specific medical conditions.

According to the Centers for Medicare & Medicaid Services (CMS) in 2025, eligibility for Medicare is determined by several factors:

General Eligibility

- Must be a U.S. citizen or a lawfully admitted permanent resident who has lived in the U.S. for at least five continuous years.

Eligibility Based on Age

- Individuals aged 65 or older are eligible for Medicare.

Eligibility Based on Disability

- Individuals under 65 who have received Social Security Disability Insurance (SSDI) or Railroad Retirement Board (RRB) disability benefits for at least 24 months.

- Individuals diagnosed with Amyotrophic Lateral Sclerosis (ALS) are eligible for Medicare immediately upon receiving SSDI or RRB disability benefits; there is no waiting period.

- Individuals of any age with End-Stage Renal Disease (ESRD) who meet specific criteria, such as requiring regular dialysis or a kidney transplant, and have filed an application for Medicare.

HAVE MEDICARE AND LOW INCOME?

See if you're dual eligibleEnjoying this article?

Follow us for more tips and insights!

How Much Does Medicare Cost?

Medicare costs vary depending on the parts you enroll in and your income level. While many beneficiaries receive premium-free Part A, others may pay a premium based on their work history. Part B premiums are income-adjusted, ranging from $185 to $628.90 per month in 2025. Additional expenses can include deductibles, copayments, and coinsurance. Opting for Medicare Advantage or adding Prescription Drug Coverage may alter your total costs.

Part A (Hospital Insurance) Costs

Premiums

| Amount | Length of Employment |

|---|---|

| $0/month | For individuals (or their spouses) with at least 40 quarters (10 years) of Medicare-covered employment. |

| $285/month | For those with 30–39 quarters of coverage. |

| $518/month | For individuals with fewer than 30 quarters of coverage. |

If you don’t qualify for premium-free Part A based on your own work history, you may still qualify through your spouse's record. If not, Medicaid may help cover premium costs if you meet income and asset limits.

Deductibles

In 2025, the Part A deductible is $1,676 per benefit period for inpatient hospital stays.

It's important to understand what a "benefit period" means, because it affects how often you might pay this deductible. A benefit period begins the day you're admitted to a hospital and ends after you have not received inpatient care for 60 consecutive days. If you're admitted again after that, a new benefit period – and a new deductible - starts.

Many people think a benefit period follows the calendar year, but it’s actually based on your personal hospital care timeline.

Coinsurance

After paying the Part A deductible, your coinsurance costs depend on how long you stay in the hospital.

| Length of Stay | What You Pay |

|---|---|

| Days 1–60 | $0 after deductible. |

| Days 61–90 | $419 per day. |

| Days 91–150 | $838 per day (using lifetime reserve days). |

| Beyond 150 days | All costs. |

Medigap plans can help cover coinsurance and deductible costs. If you qualify, Medicaid may also help with these expenses.

Part B (Medical Insurance) Costs

Premiums

Medicare uses the most recent tax information available, typically from two years ago, to determine the premium based on your Modified Adjusted Gross Income (MAGI). If your income is above certain thresholds, an Income-Related Monthly Adjustment Amount (IRMAA) is added.

Your 2025 Part B premium depends on your income and how you file your taxes. The table shows premium amounts for both individual and joint filers.

| Monthly Premium |

Individual Income | Joint Income |

|---|---|---|

| $185.00 | ≤ $106K | ≤ $212K |

| $259.00 | $106K – $133K | $212K – $266K |

| $370.00 | $133K – $167K | $266K – $334K |

| $480.90 | $167K – $200K | $334K – $400K |

| $591.90 | $200K – $499K | $400K – $749K |

| $628.90 | ≥ $500K | ≥ $750K |

If your income has dropped due to a life event (like retirement), you can request a reconsideration of your IRMAA by contacting the Social Security Administration. Medicare Savings Programs may also help lower your Part B premiums if you have limited income.

Deductibles

In 2025, the Part B deductible is $257 per year – the amount you pay before Medicare starts covering services.

Coinsurance

After you meet the deductible, you typically pay 20% of the Medicare-approved amount for most Part B services.

Choose providers who accept Medicare assignment to avoid extra charges. Medigap policies can help cover the 20% coinsurance.

Part D (Prescription Drug Coverage) Costs

Premiums

In 2025, the projected average monthly premium for stand-alone Part D plans is $40, though actual premiums vary by plan.

Higher-income beneficiaries may also pay an IRMAA (Income-Related Monthly Adjustment Amount) surcharge on top of their plan premium.

If you qualify based on your income and resources, Extra Help can lower or even eliminate your Part D premiums.

LOOKING FOR HELP WITH DRUG COSTS?

Learn about Medicare's Extra HelpDeductibles

In 2025, the maximum allowable deductible for stand-alone Part D plans is $590, though some plans may offer lower or even $0 deductibles.

Review plans carefully – a lower deductible might come with higher premiums or different cost-sharing rules.

Coinsurance

After meeting your deductible, you typically pay a percentage of drug costs, called coinsurance, during the initial coverage phase.

| Phase | Description |

|---|---|

| Initial Coverage | Pay 25% coinsurance for covered drugs after meeting the deductible, until $2,000 in total out-of-pocket spending. |

| Catastrophic Coverage | Pay $0 for covered drugs after reaching the $2,000 out-of-pocket cap for the rest of the year. |

The Medicare Prescription Payment Plan lets you spread your Part D drug costs into monthly payments, helping you manage high expenses.

Medicare Advantage (Part C) Costs

Premiums

Many Medicare Advantage plans have a 💲$0 monthly premium, but some charge an additional premium on top of your Part B premium. If the plan includes Part D coverage (most do), the cost is typically bundled into the plan’s premium.

Even with a $0 plan premium, you must still pay your Part B premium. Compare plans carefully to find the best value based on coverage and costs.

Deductibles

Deductibles vary widely by plan. Some have no deductible, while others may apply separate deductibles for medical services and prescription drugs.

Review the Summary of Benefits to understand when a deductible applies. Some plans apply it only to inpatient hospital services.

Coinsurance and Copayments

| Feature | Description |

|---|---|

| Copayments | Fixed dollar amounts for services like doctor visits, emergency care, and hospital stays. |

| Coinsurance | Percentage-based cost sharing, often for specialists or out-of-network care. |

| Out-of-Pocket Maximum | Up to $8,850 for in-network services (many plans set lower limits). |

Medicare Advantage offers cost predictability with fixed copays and an out-of-pocket cap. Always check if your doctors are in-network and if your prescriptions are covered.

Extra Benefits

Many Medicare Advantage plans include extra benefits not covered by Original Medicare, such as dental, vision, hearing, fitness programs, and over-the-counter (OTC) items. Some plans may also offer help with groceries, transportation, in-home support, or meal delivery, especially for people with chronic conditions.

Extra benefits vary by plan and may have limits or provider networks. Review the Summary of Benefits and Evidence of Coverage for full details – available online or by contacting the plan.

Should I Enroll in Medicare If I Have Employer Coverage at 65?

Turning 65 doesn’t automatically mean you have to leave your employer plan and enroll in Medicare. Whether you should enroll depends on your employer size and whether your drug coverage is considered creditable by Medicare.

Enrollment in Part A

Most people get Part A without a monthly cost, so it often makes sense to enroll even if you have work coverage.

Enrollment in Part B

- If your employer has 20 or more employees, you can usually delay Part B without penalty since your employer coverage remains primary.

- If your employer has fewer than 20 employees, Medicare becomes your primary coverage. In this case, delaying Part B enrollment is risky – your employer plan may not pay if Medicare should have been primary, and you could face late enrollment penalties for not enrolling when first eligible.

Enrollment in Part D (Prescription Drug Coverage)

Ensure your current prescription drug plan is creditable. Otherwise, you could face a penalty for skipping Part D enrollment when eligible.

Creditable coverage means your current drug plan is expected to cover at least as much of your prescription drug costs as a standard Medicare Part D plan..

How do you know if your employer-sponsored prescription drug coverage is creditable?

Your employer or insurer should send you a Creditable Coverage Notice each year. This document confirms whether your plan’s drug benefits meet or exceed Medicare Part D standards.

If you are unsure, ask your HR department or plan administrator. They are required to inform you, and you should keep the notice on file for when you eventually enroll in Medicare.

Making the Enrollment Decision

If your employer has 20 or more employees and your drug coverage is creditable, delaying Medicare enrollment may be a reasonable option.

But if Medicare would be your primary coverage, or your drug plan isn’t creditable, enrolling at 65 helps you avoid late penalties and ensures continuous coverage.

When Should I Enroll in Medicare?

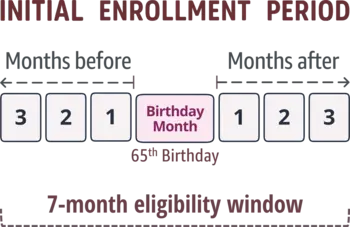

Your first chance to enroll in Medicare is during your Initial Enrollment Period (IEP), which begins three months before the month you turn 65 and ends three months after. Enrolling on time is critical to avoid late penalties and coverage gaps.

If you’re still working and have employer coverage, you may be able to delay some parts of Medicare without a penalty. (See the section “Should I Enroll in Medicare If I Have Employer Coverage at 65?” for more information.)

If you don’t enroll during your IEP, you may have to wait for the General Enrollment Period (GEP), which runs from January 1 to March 31 each year, with coverage starting July 1.

Failing to enroll during your Initial Enrollment Period (IEP) may result in permanent late penalties for Medicare Parts A, B, or D.

Late enrollment penalties apply differently to each part of Medicare. The table below shows how they're calculated.

| Part | Penalty |

|---|---|

| Part A |

|

| Part B |

|

| Part D |

|

WANT TO LEARN MORE ABOUT MEDICARE ENROLLMENT PERIODS?

View Enrollment Periods & DeadlinesWhat are the Enrollment Steps for Medicare?

Getting Medicare coverage involves a few important steps, from confirming your eligibility to setting up your plan.

Before You Enroll

1. Determine Your Eligibility

Medicare eligibility is based on age, residency, and work history. (See the section “Who Qualifies for Medicare?” for a full breakdown)

2. Decide When to Enroll

Your Initial Enrollment Period and other timing rules matter. (You can revisit the section “When Should I Enroll in Medicare?” for full timing details.)

3. Create a mySocialSecurity Account (if not already set up)

Visit ssa.gov/myaccount to create a secure login. You’ll need this to apply for Medicare online and to manage your Social Security or Medicare details going forward.

4. Decide if You Need Prescription Drug Coverage (Part D)

If you take medications regularly or want to avoid future late penalties, it’s important to consider a Part D plan. Original Medicare does not include drug coverage, so you’ll need to add a separate plan unless you’re choosing a Medicare Advantage plan that includes it.

5. Choose Between Original Medicare and Medicare Advantage

Original Medicare gives you flexibility to see any provider nationwide who accepts Medicare. Medicare Advantage plans are offered by private insurers and include extra benefits but often require using a network. Consider your doctors, prescriptions, and any travel needs.

If staying with Original Medicare, consider adding:

- Medigap (Medicare Supplement Insurance): Helps cover deductibles, coinsurance, and copayments. Plans are lettered (e.g., Plan G, Plan N), and pricing varies by insurer and state.

- DVH (Dental, Vision & Hearing) Supplemental Plans: These are standalone policies from private insurers and are not included in Original Medicare.

If choosing Medicare Advantage:

- Review and Compare Plans Based on Coverage, Benefits, and Costs: Use medicare.gov/plan-compare to search by ZIP code. Look at premiums, drug formularies, provider networks, and out-of-pocket maximums.

Enroll

1. Enroll in Medicare Part A and Part B

If not automatically enrolled, apply online at ssa.gov/medicare or call Social Security at 1-800-772-1213. You'll need your Social Security number and basic personal information. You can also visit a local Social Security office, though appointments are recommended.

2. Complete Enrollment Based on Your Decided Path

If staying with Original Medicare, enroll in add-ons as needed:

- Medigap: Purchase directly from a private insurer. To avoid medical underwriting, apply within 6 months of your Part B start date.

- DVH (Dental, Vision & Hearing) Plans: Shop and enroll through private insurers or licensed agents.

- Part D: Use the Medicare Plan Finder to compare and enroll in a drug plan that covers your prescriptions.

If choosing a Medicare Advantage Plan:

- Enroll using the Medicare Plan Finder, call 1-800-MEDICARE, or work with a licensed agent. Importantly, you must be enrolled in both Part A and Part B first.

3. Set Up Premium Payments and Review Confirmation Details

You can have premiums deducted from your Social Security check, set up an automatic bank draft, mail in a personal check, or pay through your online account.

After enrolling, review your Medicare card and plan confirmation documents to ensure your details are correct and your coverage start date is accurate.

How do I Choose the Right Medicare Option for My Needs?

Get Help from a Licensed Agent

Medicare can be confusing, but you don’t have to figure it out alone. A licensed insurance agent can:

- Break down your options in plain language.

- Compare plans based on your specific needs and budget.

- Walk you through the enrollment process.

- Help you consider long-term care insurance, if appropriate.

Hesteon Solutions provides free, personalized guidance to help you explore your Medicare choices and enroll with confidence.

Need Medicare help? Whether you are turning 65 or reviewing your coverage, we are here for you.

We are here to help.

Speak with a licensed insurance agent

OR

Other options

Follow us for the latest updates!

Receive Medicare news, current senior health trends, and helpful tips delivered to your newsfeed.